Features

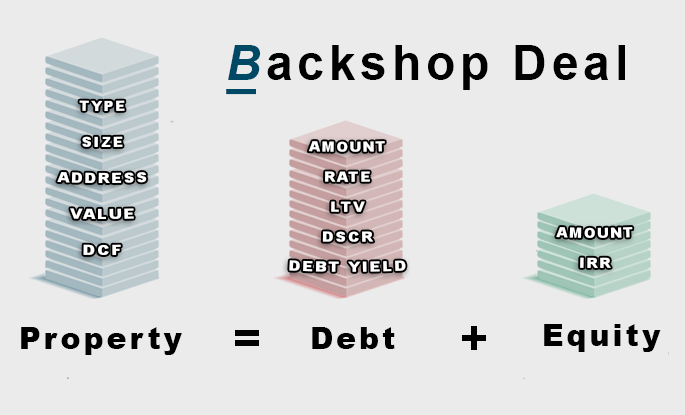

Full deal-stack modeling

Backshop was the first web-based software application to model the entire deal stack, from properties to debt to equity. Our underwriting and asset management application enables businesses to make smarter, faster and more profitable decisions.

Backshop provides CRE professionals with a single, secure, easy-to-use application that expedites the decision-making process, improves organizational productivity and delivers greater transparency.

Backshop supports cash flow modeling for all property types and loan types. Backshop can be implemented without custom software configurations and is available for licensing on both a direct and SaaS basis.

Backshop™ empowers enterprises by:

- Breaking their reliance on outdated, clumsy tools like Excel™, Word™, and Argus™

- Managing the entire deal pipeline, workflow, documents and contacts from any connected device.

- Valuing buildings using direct capitalization and discounted cash flow methods

- Modeling debt structures and deriving critical statistics like Loan to Value, Debt Service Coverage Ratio and Debt Yield

- Calculating the projected Internal Rate of Return of your equity investments based on ownership structures and equity contributions

- Preparing complete and comprehensive deal reports in both PDF and Industry Standard XML for all deal counterparties

- Accessing our database of all CMBS loans

Loan origination

Improves the transparency and productivity of your commercial lending operation.

- Streamline the Lending Process

- Create Transparent models

- Manage the entire loan, from pipeline to closing

- Self Hosted or SaaS models available

Learn more >>

Asset management

Confidently assess the value of and proactively manage the assets (loans, equity and CMBS bonds) that make up your portfolio.

- Model Scenarios

- Track Key Data

- Access & Share Critical Documents Securely

- Web-based Interface Creates Highly Available Data

Learn more >>

Exit plan management

Backshop facilitates all types of exit plans, including securitization, syndication, fund management, crowd funding, and straight balance sheet

- Data Tapes & Investor Reporting

- Rate Locks, Extensions & Unwinds

- Ability to Assign Multiple Buyers to Each Tranche

Learn more >>

Document and contact management

Simple, cost-effective methods to comply with all document sharing needs.

- Available stand-alone or as an integrated Backshop™ module

- Full Folder Control & Comment Ability

- Full Audit Capability

- Extensive Search Capability

Learn more >>

Integrated CMBS data library

Allows easy lead generation to identify opportunities, comp searches to see current rates and loan terms, and loan level loss projections backed by lease level collateral valuations to accurately predict timing and severity of CMBS bond losses

- The entire U.S. CMBS population

- Over 900 securitizations

- Over 100,000 properties and loans

- Over $1 trillion in bonds

Learn more >>